10 questions to ask a girl to make her wet

Words are extremely powerful to make anyone do stuff for you. Seducing a girl isn’t easy at times, but you may choose to do it…

Words are extremely powerful to make anyone do stuff for you. Seducing a girl isn’t easy at times, but you may choose to do it…

The forex market is the largest and most liquid market in the world.All aspects of buying and selling currencies go through the market, which is…

Ideal Image is the nation’s #1 personal aesthetics brand. Reviews from hundreds of satisfied customers tell the reasons why. Ideal Image Is Staffed by People Who Care…

Bras are designed to provide support to the breast. To enhance the appearance of the breast and flaunt bust line, padded bras were invented. Because…

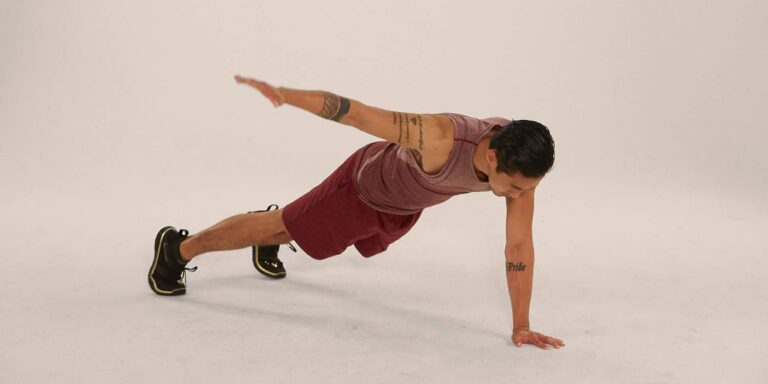

Achieve a healthier life by following these chest workout at home, it is simple, and it will take you little time! Getting pectorals of steel…

We all are well aware of the feel that dupattas are capable of adding to our outfits along with accentuating them. Whether it is just…

The first and most important rule of men’s fashion is that you should feel at ease and confident in your attire. You’ll need both of…

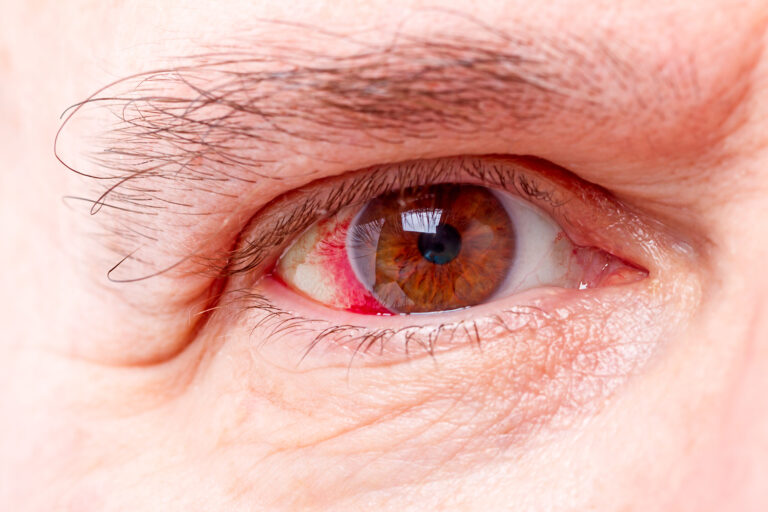

Damage to the retina is more common than you think. In fact, retinal damage affects millions of people across the world. And as the condition…

Wearing formal shoes for men is a must. It helps you look more confident and sophisticated. However, it can be challenging to find the right…

Navratri, because of the nine days of joyous celebrations it brings, is an occasion we all love and patiently (but also excitedly!) wait for all…

The demand and popularity of online loans have been on the rise in the past couple of years. These are the types of unsecured loans…

How many of us have had to put up with wearing glasses? Unfortunately, it’s a fact that for nearsighted people, the only way to improve…